Can You Make Money Trading Otc Stocks

Learning how to twenty-four hours trade penny stocks has skyrocketed in popularity over the years as more and more people gain interest, simply what are penny stocks and why are they so pop?

What are Penny Stocks?

According to the Securities Exchange Commission (SEC), the penny stock definition is any security trading under $5.00 per share.

Most of these companies are relatively new, accept a pocket-sized market capitalization and haven't established a runway tape equally successful businesses which makes them speculative investments for traders and investors.

How to Trade Penny Stocks For Beginners: Course 1 of 4 past Ross Cameron

So, what are penny stocks? Well, for starters, they are cheap which means yous don't need a ton of upper-case letter to put on a large position and they regularly accept huge runs over a 100% or more in just one day!

The allure of making these big returns has attracted all types of new traders and is why they have gained so much popularity.

However, it is just as easy to lose all your coin, or even more if your trading on margin, due to the volatility involved with penny stocks.

That'due south why it is important to understand how to trade them and what to expect for before risking whatsoever of your hard-earned coin!

How I Got Started In Penny Stocks

I was beginning introduced to trading penny stocks when a friend in high school fabricated tens of thousands of dollars day trading penny stocks over summer break.

This would take been around 1999/2000 and at the time trading online with TD Ameritrade was still a new concept.

I e'er knew at that place was potential to make coin in the stock market with a minor account only I didn't know how. I decided to open my ain account just I was trading stocks like CAT, IBM, and AAPL. With my $1k account I made about $17 dollars.

I was investing in the incorrect stocks for big percentage growth. In order to grow a pocket-size corporeality of money ($500.00), we need to trade stocks that could double or triple in less than a calendar week!

That'll rarely happen with big companies like FB or NFLX, but it can happen a lot with penny stocks!

OTC Penny Stocks vs NYSE/NASDAQ Penny Stocks

Many of you have seen the movie Wolf of Wall Street with Jordan Belfort. In that movie, they were trading penny stocks that are called Pink Sheets.

These penny stocks trade over the counter (OTC), which means they are not listed on the NYSE or NASDAQ exchanges and are companies that don't accept to adhere to strict fiscal requirements required by major exchanges.

To be listed on the largest national exchanges you must be fully transparent about your financials, and your stock must remain in a higher place $one.00 per share.

We Avoid OTC Penny Stocks

Companies that are not willing or able to provide complete fiscal documentation, who cannot go along their stock above $ane.00 per share, or who are in bankruptcy filings, will merchandise on the OTC markets.

We do not merchandise penny stocks trading over the counter mainly because of the lack of liquidity along with the lack of regulations in the OTC market. They are far more susceptible to manipulation which makes them dangerous to trade.

Listed penny stocks, or stocks trading on an exchange similar the NYSE or NASDAQ is where we focus our attention. They have the ability to make huge moves intraday and are cheap enough to put on large positions.

The four Tiers of Penny Stocks: Redefining "Penny Stocks"

Stocks trading under $i.00 were about always pocket-size companies struggling to find their place in the market and as a event those securities were very speculative investments for traders or investors.

In this mean solar day and age, securities priced betwixt $one-10.00 in many cases still stand for some of the most speculative and risky investments. This is especially true for modest companies in the Biotech, Internet, and Fintech sectors.

These stocks can come out with news overnight that consequence in a 50% drop to the downside or a 100% squeeze to the upside. Anyone investing or day trading in these types of securities has to exist prepared for the possibility of a full loss.

But for reference, when I took $583.xv and turned it into over $100k in 44 days, I was primarily trading stocks between $1.00 – $v.00. These stocks all come across the min list requirements for the exchanges, which is important to me.

If I'm putting my hard earned coin into a stock, I desire to feel confident the visitor isn't going to disappear overnight.

Penny Stock Tiers

Tier 1 Penny Stocks: These are the penny stocks that we focus. They are listed on a major exchange like the NYSE or NASDAQ and are usually priced below $v.00 per share merely can be a little higher priced than that. Tier 1 penny stocks are even so speculative only less open to manipulation because they are required by the exchanges to provide fiscal data and are held to a college standard than OTC penny stocks.

Tier two Penny Stocks: Traditional penny stocks, in my stance, are stocks priced between one cent and 99 cents. They aren't below 1 cent (if you didn't already know, stocks can trade at fractions of a penny). It'southward not uncommon to see a stock priced between 1 cent and 99 cents that is still listed on the NYSE or NASDAQ.

These companies will typically get a letter (which is made public), that they need to meet the listing requirements to have their stock higher up $1.00 within a certain amount of time. If they do information technology, the stock remains listed, if they tin't information technology volition exist de-listed and motion to the OTC market exchange.

Yet, it's very of import to note that stocks that trade above $ane.00 volition never have a spread less than 1 penny. That ways the stock will merchandise ane.01 10 1.02, or 1.05 by one.06, but never 1.015 ten 1.017. When a stock trades BELOW $1.00, the stocks will trade downward to fractions of a penny.

Tier iii Penny Stocks: Sub-Penny Stocks are stocks that are below ane penny per share. So that starts at .0099. These volition non exist NYSE or NASDAQ stocks, so for that reason I wouldn't trade them. These aren't specially noteworthy beyond the fact that the companies aren't strong enough to fifty-fifty have their stock priced at ane penny per share.

Tier 4 Penny Stocks: Trip Zero Stocks (Priced .0001 – .0009) Trip Zero Stocks are priced with 3 zeros. These are stocks priced between .0001 and .0009 per share.

As you can imagine these stocks after oft used every bit vehicles for manipulation. Each increment the stock moves up is a 100% move versus the entry price of .0001.

Many of the "hot penny stock" alerts are on sub penny stocks or trip zero stocks and primarily do good the people who commencement bought the stock.

If somebody buys 100mil shares at .0001 ($10k) and the stock goes up to .0010 they volition sell with $100k in profits. Many of the stock promotion newsletters are sent by people who bought huge positions of these penny stocks.

Trading Penny Stocks For Beginners

Many people would consider becoming a millionaire by day trading penny stocks to be the ultimate rags to riches story. Past trading the cheapest stocks on the market, y'all can invest pocket-size amounts of money and see huge returns.

Simply how hard is to make a living day trading penny stocks? It's a lot harder than most would imagine.

The allure of quick returns draws the crowds into the penny stock marketplace, where many end up losing their shirts. At the finish of the day, only ten% of agile traders in the market place will actually be profitable.

The rest are giving their coin abroad to ameliorate traders.

Later about eighteen months of trial and error, I realized that there are a handful of stocks everyday that make big moves. The flim-flam is learning to find those stocks BEFORE they make the big move.

That became the basis for the momentum day trading strategy that I'one thousand trading today. I use this to solar day trading penny stocks & small cap stocks.

Criteria for trading them: news catalyst , bladder nether 100m and high relative volume.

How To Discover the Best Penny Stocks To Buy

The offset stride to trading penny stocks successfully is you mustbe in the stocks that have the highest probability of making a potent run. But how practise we know which ones will be the big movers?

That's where our proprietary scanners come into play. I have customized them to observe stocks that only see my specific parameters which gives me an edge because I only want to trade stocks that I know have the potential to make a large run.

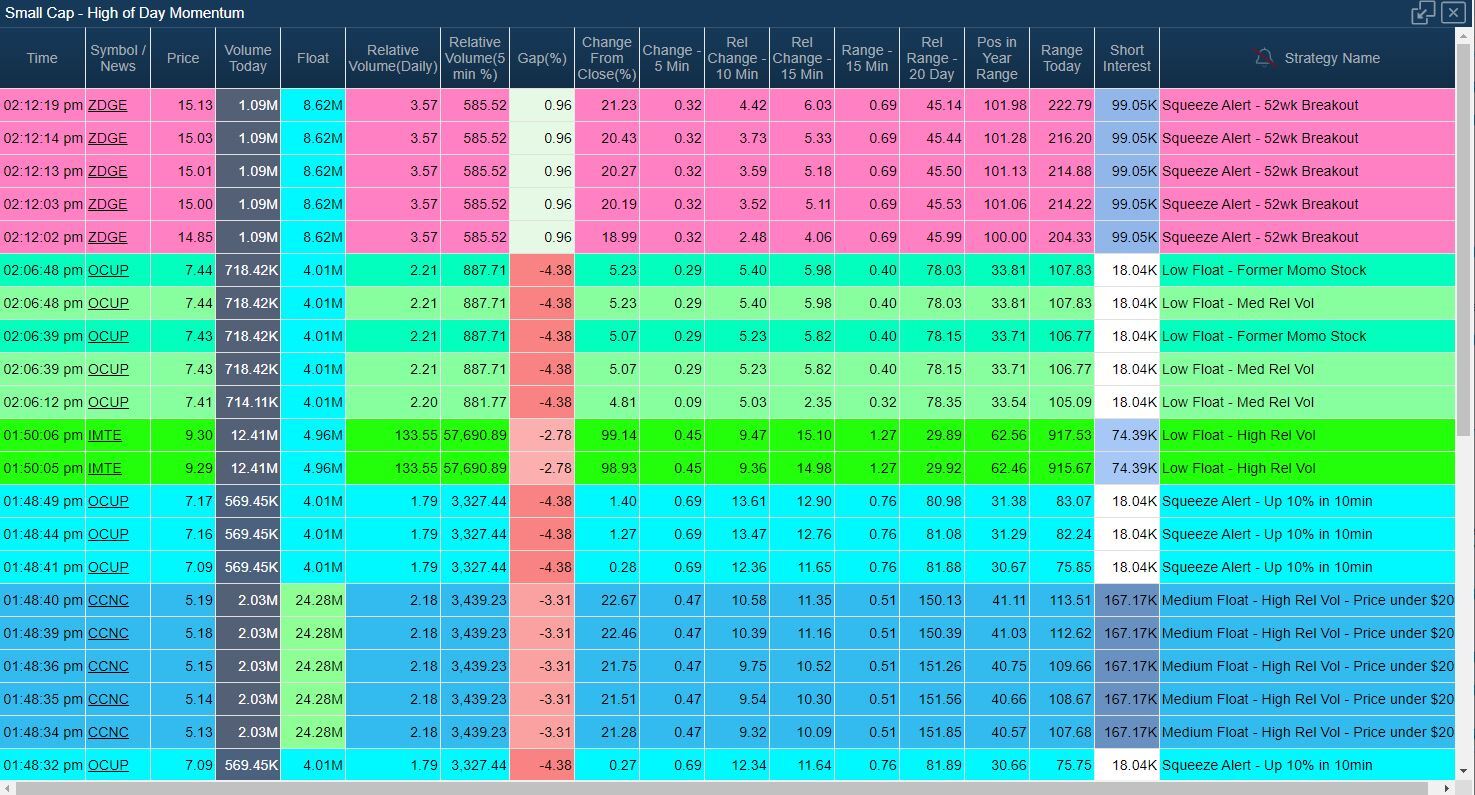

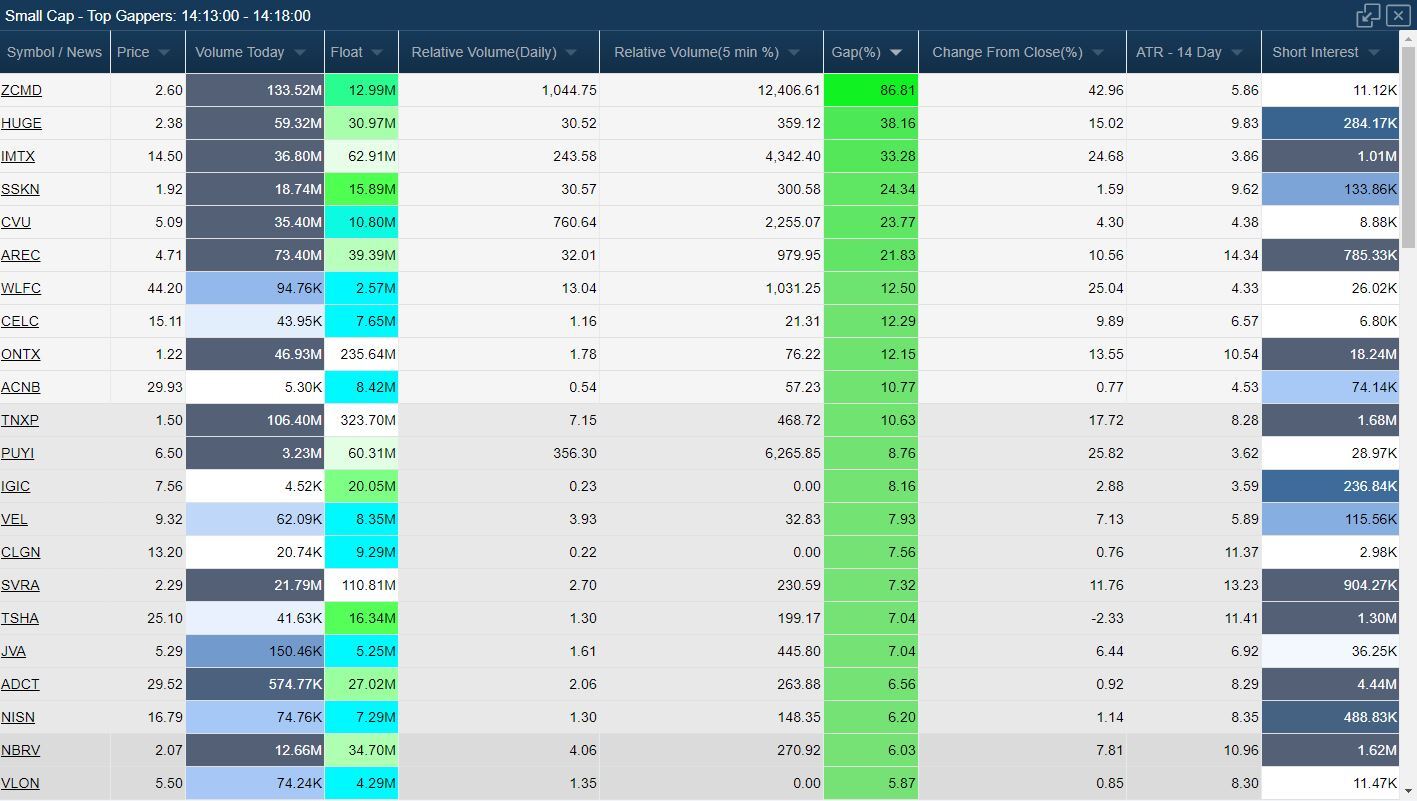

My two main scanners are Small Cap – Top Gappers and Small Cap – High of Day Momentum. Both of them browse for stocks that are moving big on loftier volume.

Small Cap – High of Twenty-four hour period Momentum

The High of Day Momo scanner is groovy for later on the marketplace opens. It picks up stocks that are surging up on high volume and with in our cost parameters. If I don't accept any stocks that I am watching in the premarket then this will exist my get-to scanner.

Small Cap – Top Gappers

The Gap Scanner volition show all of the stocks that meet my book and toll parameters just are also gapping upwards in the premarket, which tells me that they usually accept some kind of news catalyst.

I can and then sort the scanner past how much volume the stock has had or by what percentage the stock is gapping up.

I accept three specific parameters that I apply to look for penny stocks that take the highest probability of making a huge run.

Parameter 1: Breaking News – First I look for stocks that are gapping up considering of some kind of news goad like FDA blessing or earnings but we want to stay away from whatever stocks that are beingness bought out because they usually don't trade away from their purchase cost.

Parameter two:Float –Ideally I want to the bladder to exist nether 100 million shares but nether l meg is even better. This is because when a stock has a pocket-sized amount of shares to trade and there is a lot of buying interest then information technology could push button shares up very quickly which is exactly what we are looking for.

Parameter iii: High Relative Volume–I like to see the stock agile in the premarket with solid book. Usually stocks with news will be gapping up in the premarket on actually good book then I know right off the bat that this stock volition accept plenty of liquidity for me to merchandise with size.

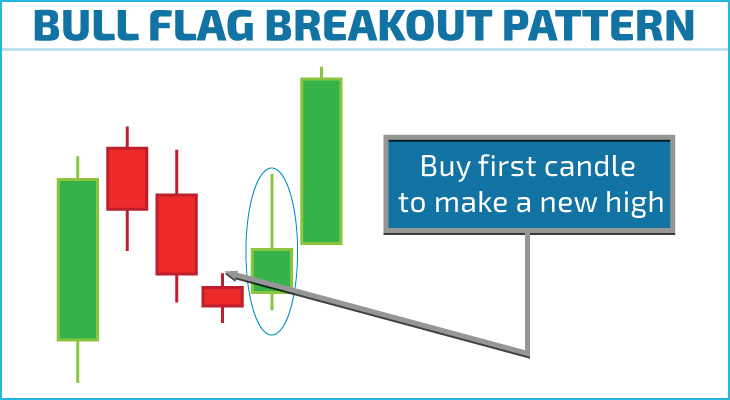

Once I make my watchlist of the all-time-looking stocks with the above criteria I will wait for the marketplace to open and encounter if breakout over premarket highs for an entry or look for a bull flag pattern.

Penny Stock Chart Patterns

One of my all fourth dimension favorite patterns is the balderdash flag pattern. It is super like shooting fish in a barrel pattern to spot and it has a defined risk point where you know exactly when yous are wrong on the trade and information technology is fourth dimension to go out.

You lot want to run into the stock run higher and then have a low-cal book pullback, unremarkably to the ten or 20 24-hour interval moving average on the 1 or 5-minute chart, where it volition observe support and buyers volition jump back in to take it college.

The key to trading this pattern is waiting for volume to option back upwards as buyer'south pile in and so jumping in with them.

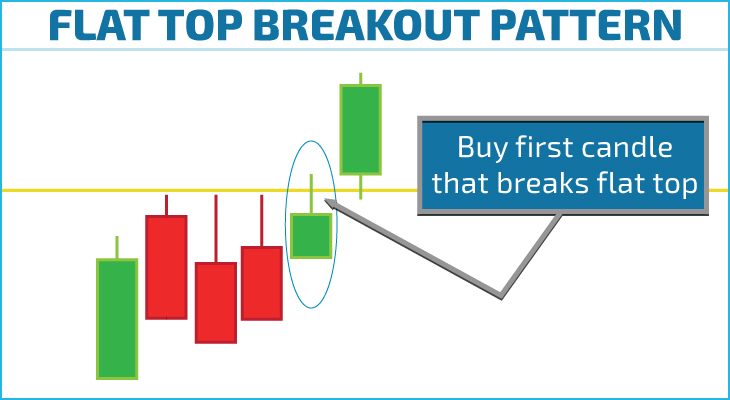

My other favorite pattern is a flat top breakout over premarket highs. Shorts will put stop orders in only above highs so I know if it breaks higher up it nosotros will run across their buy stop orders trigger which will help button shares higher.

This blueprint isn't as easy to define risk so you can become nearly it a couple dissimilar ways. You can use the low of the candle that breaks out higher up the premarket highs OR you can apply a set amount to risk like 20 cents for example.

Are you a Penny Stock Day Trader or a Penny Stock Investor?

In my feel penny stocks are and then volatile, unpredictable, and field of study to market manipulation, that existence an investor is nearly impossible.

You demand to have a brusque term outlook in order to survive, and you need to be one of the first traders to go far and the showtime traders to exit with turn a profit.

Remember that a penny stock company tin have a horrible balance sheet, atrocious fundamentals, and so fasten up 200% on breaking news of a new partnership.

For this reason, shorting penny stocks expecting the companies will go broke is extremely risky. The fundamentals will matter somewhen, just in the meantime, most investors can't handle belongings a position down 200%. I'1000 a penny stock day trader.

This ways I follow a few very specific rules about how to pick stocks and how to merchandise them.

Day Trading Penny Stocks at this point is like riding a bike for me. As this point, I can make $100k in 3 months without breaking a sweat, but remember information technology took me years to become to this point.

One of my favorite things is working with beginner traders in our Day Trading Courses because I know what it's like to exist brand new to the marketplace!

The reason working with beginner traders is so much fun is because I think what it was like to be a beginner trader.

I consider myself to be no unlike from beginner traders, the just difference is that I'yard a niggling further down the road to success and I can await back at where you are today and know what information technology takes to go y'all to where I am today.

5 Tips To Live By Equally A Penny Stock Day Trader

- Avoid OTC/Pink Canvas-Listed Penny Stocks

Companies trading on the OTC (over the counter) market have fewer regulations placed upon them as compared with stocks listed on the NASDAQ and NYSE. As a upshot, stocks on the OTC market are highly susceptible to manipulation and fraud. The merely penny stocks I merchandise are listed on the NYSE or NASDAQ. I know these companies are facing stricter requirements to maintain compliance - Don't Autumn for the Promotional Pumps!

Many OTC Penny Stocks become promoted at one signal or another. These promotions often come up with messages like "this stock will be the side by side Apple". The reality is, the next Apple is not probable to come from the penny stock world. It's more likely the next large tech company will beginning as a big visitor that IPO's well to a higher place the penny stock price range, and then continues higher. When you are buying penny stocks to agree in hopes that it volition be the next Apple, you become an investor of i of the virtually speculative financial instrument on the market. - But Trade Penny Stocks with Book

Information technology's really important to avoid illiquid penny stocks. Most penny stocks trade only a few thousand shares a day. Even so, when a penny stock has breaking news, they will often trade at 40-50x relative volume achieving 5 to x meg shares of book on a big mean solar day. These are the days I'll merchandise a penny stock. The adept news is that there is a penny stock having a one time in a twelvemonth event almost everyday! This means every bit a trader there is near always something to look at. - The Hit and Run Approach

In one case a penny stock has met my standards for beingness worthy of trading (having news, volume, and beingness NYSE/NASDAQ listed), I'll look for i of my Go To setups. These include Momentum, Gap and Go, and Reversal Trades. An important dominion is that I should never over trade these stocks. For that reason, I only take the most obvious setups.I buy in the place where I expect thousands of other traders volition likewise enter. These entries are based on back up and resistance patterns. Once I accept a profit, I sell 1/2 my position and adjust my finish loss to interruption-even. By quickly taking profit and adjust stops, I ensure small winners at the least. Occasionally I'll get into a penny stock and become a big winner, but as a trader, I look for many minor wins. - Making a Living i Trade at a Fourth dimension

Information technology's important that I don't look to hit abode runs, to make 10-20k in a single merchandise. My focus is to merchandise penny stocks near everyday and have a daily goal of $500-1k/day. That ways anywhere from 100-200k in annual profits. Many small base of operations hits ads up over the course of weeks, months and years. My focus is making a living by trading, rather than investing in penny stocks.

Want To Acquire More?

Many beginner traders start their trading journey with penny stocks. We actively encourage traders to Avoid penny stocks and instead trader stocks priced between $3-ten.00.

These are stocks that have the potential to make 20-thirty% intraday motion, simply retain the security of existence listed on NYSE and NASDAQ.

Every bit a outcome, they are more popular among traders and are often considered safer vehicles for trading and investing.

As you probably already know, I'one thousand an active trader of stocks priced between $2-xx, and occasionally trading stocks as loftier as $200. I merchandise stocks reporting breaking news such as earnings, contracts, FDA announcements, or other PR'southward.

I look for that stock that is having a once a year event because that's the stock every mean solar day trader will be watching.

Click the link beneath to learn more about trading penny stocks and how you can get started!

Final Thoughts

Trading penny stocks isn't for everyone. It requires a sure corporeality of risk tolerance along with the ability to react chop-chop in uncertain situations.

However, if you think yous have the skills to day trade penny stocks and so you need to make sure yous brainwash yourself on how to merchandise them along with money management techniques to avoid losing all your difficult-earned capital.

I'd likewise recommend starting off in a trading simulator where you tin exercise trading without risking real money.

This will get you use to how fast moving stocks trade and volition also requite you exercise using hotkeys, which are a must have when trading penny stocks or any other type of momentum based strategy.

Promise this guide helped you on your journeying to becoming a successful trader but let us know if you have any questions in the comments department below!

Source: https://www.warriortrading.com/penny-stocks/

Posted by: rodriguezmorbigh1992.blogspot.com

0 Response to "Can You Make Money Trading Otc Stocks"

Post a Comment